Trade CFDs on FX, Stocks and more with a leading global broker

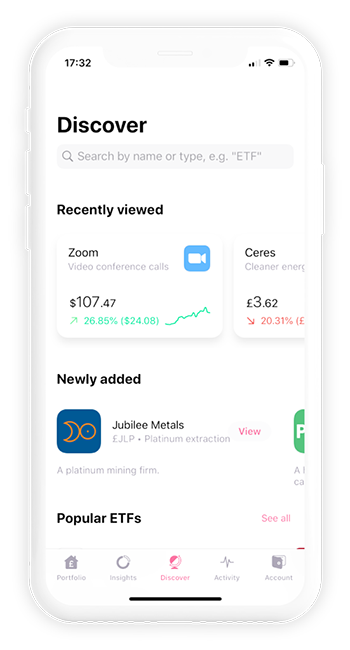

Discover over 5,800 stocks, ETFs and REITs on one brokeage

More investment options. More opportunities to grow. Trade stocks or make long-term investments on the same platform

Take that Step

With Altruistic Markets you get a transparent pricing structure and a secure and regulated trading environment. As an active trader, you can also qualify for lower fees and extra benefits.

- Access to US investments

- Commission- free stock trades

- Trade flexibility

- Real-time stock prices

- Local deposit methods

- Seamless US Dollar conversion

Why ChooseAltruistic Markets

Altruistic markets is specially designed to help you start investing easily, completed with supporting features so users can feel the perfect investing experience.

Put your money to work with Auto-trade

Create an investing plan that match your goal and budget. Deposit, invest and reinvest automatically.

Fractional Shares

Own a piece of even the most expensive US shares. Invest from only $1,000.

Award-winning Investment Company

Great for beginners and experienced investors alike.

ETFs & Investment Trusts

Choose from a wide range, covering different sectors and markets worldwide.

US, UK & European Stocks

Choose from thousands of stocks listed on the London Stock Exchange, NYSE, NASDAQ and beyond.

World-class Customer Support

Our multilingual customer support team is ready to help you - 24h hours a day.

Get started with as little as $1,000

Build and track the portfolio that suits you.

Discover thousands of assets on one brokerage

Explore thousands for US, UK, and European shares and ETFs.

Create an Account Now!

Open an account for free withAltruistic Markets now!! Access Active day trading, Auto-trade features and long term investment.

Our Security Measures

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Our strong capital position, conservative balance sheet and automated risk controls are designed to protectAltruistic Markets and our clients from large trading losses.

$13.8B

Equity Capital*

$8.5B

Excess Regulatory Capital*

2.05M

Client Accounts*

1.95M

Daily Avg Revenue Trades*

FCA authorised

We are authorised and regulated by the FCA.

FSCS protected

Your funds are protected by the FSCS scheme up to $85,000.

Account Security Standard

Password protection with Bcrypt hashing algorithm.

Data protected

We follow industry best practices to protect your data at all times.

Educational Resources

Even the most experienced traders or investors need to keep learning to stay ahead.Altruistic Markets provides several resources to help you better understandAltruistic Markets products and services, markets and technology.

Academy

Webinars

Insights

Podcasts

TradingLab

Investing and Trading in Stocks

Stock trading has been a popular financial pursuit since stocks were first introduced by the Dutch East India Company in the 17th century. This is both an efficient and effective type of investment for both families and individuals.

Stocks, also commonly referred to as equities or shares, are issued by a public corporation and put up for sale. Companies originally used stocks as a way of raising additional capital, and as a way to boost their business growth. When the company first puts these stocks up for sale, this is called the Initial Public Offering. Once this stage is complete, the shares themselves are then sold on the stock market, which is where any stock trading will occur.

People occasionally confuse buying shares with physically owning a portion of that company as if this somehow gives them the right to walk into the company offices and begin exerting their ownership rights over computers or furniture. The law treats this type of corporation in a unique way; as it is treated as a legal person, the corporation, therefore, owns its own assets.

This is referred to as the separation of ownership and control.

The separation of these things is beneficial to both the shareholders and the corporation because it limits the liability for each party. For example, if a major shareholder were to go bankrupt, they cannot then sell assets belonging to the corporation to cover their debts and pay their creditors. This is the same in reverse; if a corporation you own shares in goes bankrupt and the judge orders them to sell all their assets, none of your own personal assets are at risk.

One thing lies at the core of a stock’s value: it entitles shareholders to a portion of the company profits.

A stock market is where stocks are traded: where sellers and buyers come to agree on a price. Historically, stock exchanges existed in a physical location, and all transactions took place on the trading floor. One of the world’s most famous stock markets is the London Stock Exchange (LSE).

Yet as technology progresses, so does the stock market. Now we are seeing the rise of virtual stock exchanges that are made up of large computer networks will all trades performed electronically.

A company’s shares can be traded on the stock market only following its IPO, making this a secondary market. The large businesses listed on global stock exchanges do not trade stocks on a frequent basis. Stocks can only be purchased from an existing shareholder, not directly from the company. This rule also applies in reverse, so when selling your shares, they go to another investor, not back to the corporation.

The reason traders choose to invest in stock is because the perceived value of a company can vary greatly over time. Money can be made or lost; it depends on whether the trader’s perceptions of the stock value are in line with the market.

Trying to predict the price movements of stocks in the short term is nearly impossible. Generally, stocks do tend to appreciate in value in the long term, so many investors choose to have a diverse portfolio of stocks that they intend to keep for a long time. Bigger companies pay dividends to their shareholders, which is a portion of the company’s profits. The value of the share itself will not impact the dividend.

In order to trade stocks, there must be a seller and a buyer; as not all traders have the same agenda, stocks are bought and sold at different times and for different reasons. Someone may sell their stock for profit, others sell it in order to cut losses, and some because they believe the value of the stock is about to change either way.

All forms of financial investment carry a level of risk, and stock trading is no different. Even traders with decades of experience cannot predict the correct price movements every single time.

People use various strategies, but it is important to note that there is no such thing as a failsafe strategy. It is also advisable to limit the amount of money you invest in a single trade, as part of your own risk management.